The PUFFER Token

The PUFFER token is the native governance token of the Puffer Protocol and UniFi ecosystem.

The Role of PUFFER

Puffer LRT

- Govern key protocol parameters (fees, limits, bond requirements)

- Select guardians and restaking operators

- Curate supported AVSs

- Future feature: Help allocate ETH to different operators and AVSs (more details coming soon)

UniFi AVS

- Manage fee structures

- Whitelist new rollups for AVS support

- Oversee AVS security parameters

- Guide the integration of new preconfirmation and proposer commitment services

UniFi Rollup

- Set fee parameters for rollup transactions

- Direct ecosystem rewards to promote adoption

- Manage treasury funds for long-term sustainability

- Steer rollup upgrade decisions and feature prioritization

PUFFER Allocations

The PUFFER token has a maximum total supply of 1,000,000,000. As of writing, there is currently an initial circulating supply of 102,300,000 (10.23%) PUFFER tokens.

In the table below, we have a breakdown of how the PUFFER tokens are allocated across the Puffer ecosystem.

| Allocation | Percentage | Description |

|---|---|---|

| Ecosystem and Community | 40% | Allocated to initiatives that build a dynamic and engaged ecosystem, rewarding community support and ensuring continuous growth. This reserve will fund future airdrop seasons, community incentives, and initial liquidity on exchanges. |

| Airdrop Season 1 | 7.5% | Allocated to the Crunchy Carrot Quest Season One airdrop, available immediately to reward early Puffer supporters from the Crunchy Carrot Campaign. 65% is available on day 1 and for larger depositors, the rest is vested over 6 months for equal opportunity for all of our community. |

| Airdrop Season 2 | 5.5% | Allocated to Crunchy Carrot Quest Season Two participants. Season 2 has already started after the snapshot of Season 1 on October 5, 2024. |

| Investors | 26% | By providing resources and support, investors enabled Puffer to build great products for the community. Investors will receive their allocation over 3 years, with a 1-year cliff and 2 years vesting. |

| Early Contributors & Advisors | 20% | This allocation is for the Puffer core team and advisors, who are fully committed to Puffer's success. This will vest over 3 years, with a 1-year cliff, ensuring long-term dedication to the ecosystem's vision. |

| Protocol Guild | 1% | In alignment with the Protocol Guild Pledge, 1% of the total $PUFFER supply will support Ethereum core development, vested over a 4-year period. This contribution strengthens the security and scalability of Ethereum, benefiting the broader ecosystem. |

vlPUFFER

vlPUFFER is Puffer Finance's governance and locking system. By locking your $PUFFER tokens, you gain voting power (vlPUFFER), participate in governance, and become eligible for exclusive rewards.

What is vlPUFFER?

When you lock your $PUFFER tokens, you receive vlPUFFER in return, a non-transferable token representing your voting power within the Puffer ecosystem. The longer you lock, the higher your multiplier and the more vlPUFFER you receive.

Your vlPUFFER balance determines your influence in governance votes and reward distributions.

How it Works

- Lock your $PUFFER tokens for a chosen duration (from 30 days up to 2 years).

- The system grants you vlPUFFER based on a multiplier determined by the lock duration.

- Use your vlPUFFER to vote in governance, influence emissions, and access certain protocol rewards.

- After the lock period ends, you can withdraw your original $PUFFER tokens.

vlPUFFER is non-transferable. It cannot be traded or moved between wallets. It only represents voting power.

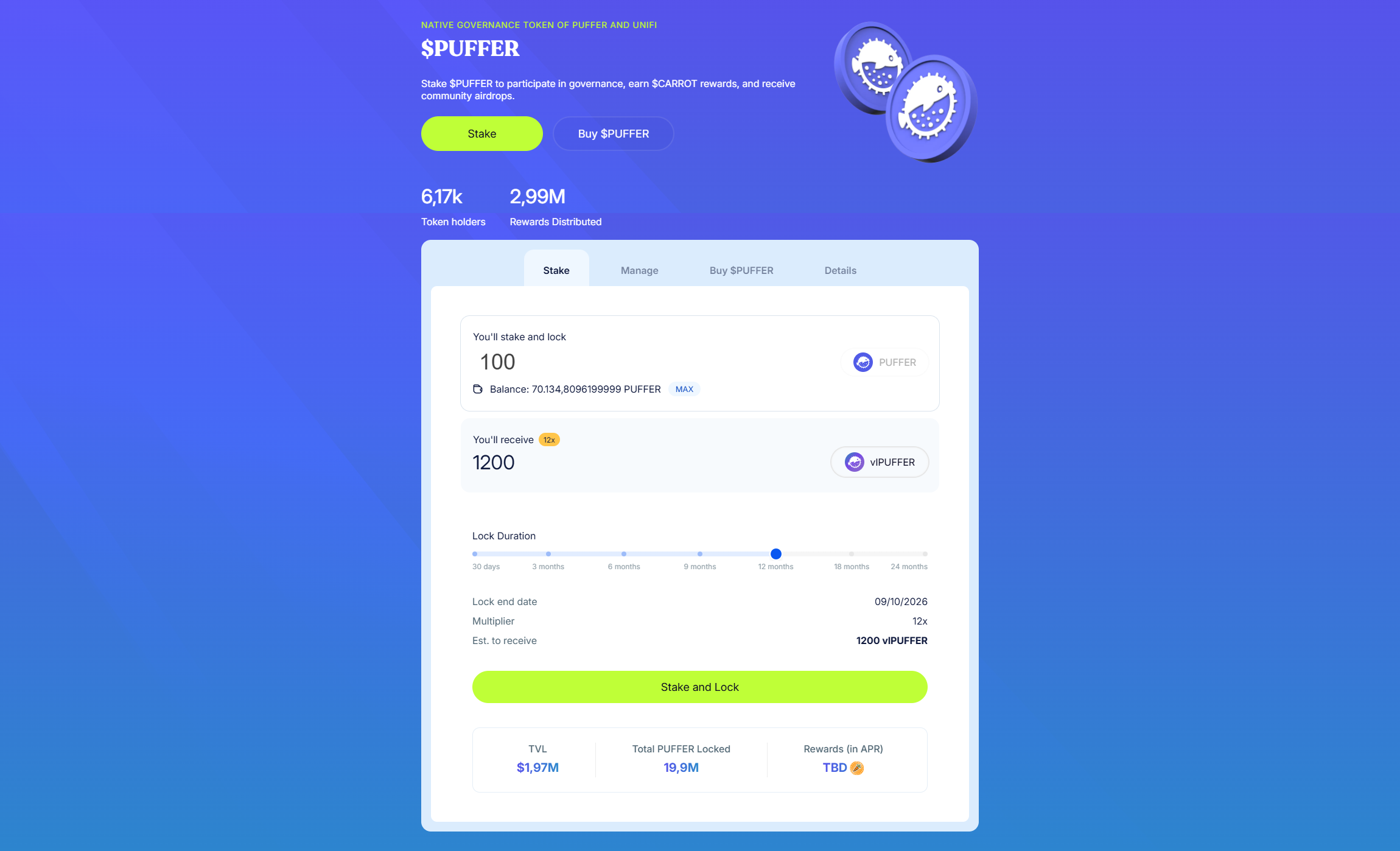

Lock Duration and Multipliers

| Lock Duration | Multiplier |

|---|---|

| 30 days | 1x |

| 3 months | 3x |

| 6 months | 6x |

| 9 months | 9x |

| 12 months | 12x |

| 18 months | 18x |

| 24 months | 24x |

Example: Locking 100 $PUFFER for 12 months gives you 1,200 vlPUFFER (12x multiplier).

Locking your $PUFFER

This is the interface that allows you to stake your $PUFFER here.

Minimum lock amount: 10 $PUFFER

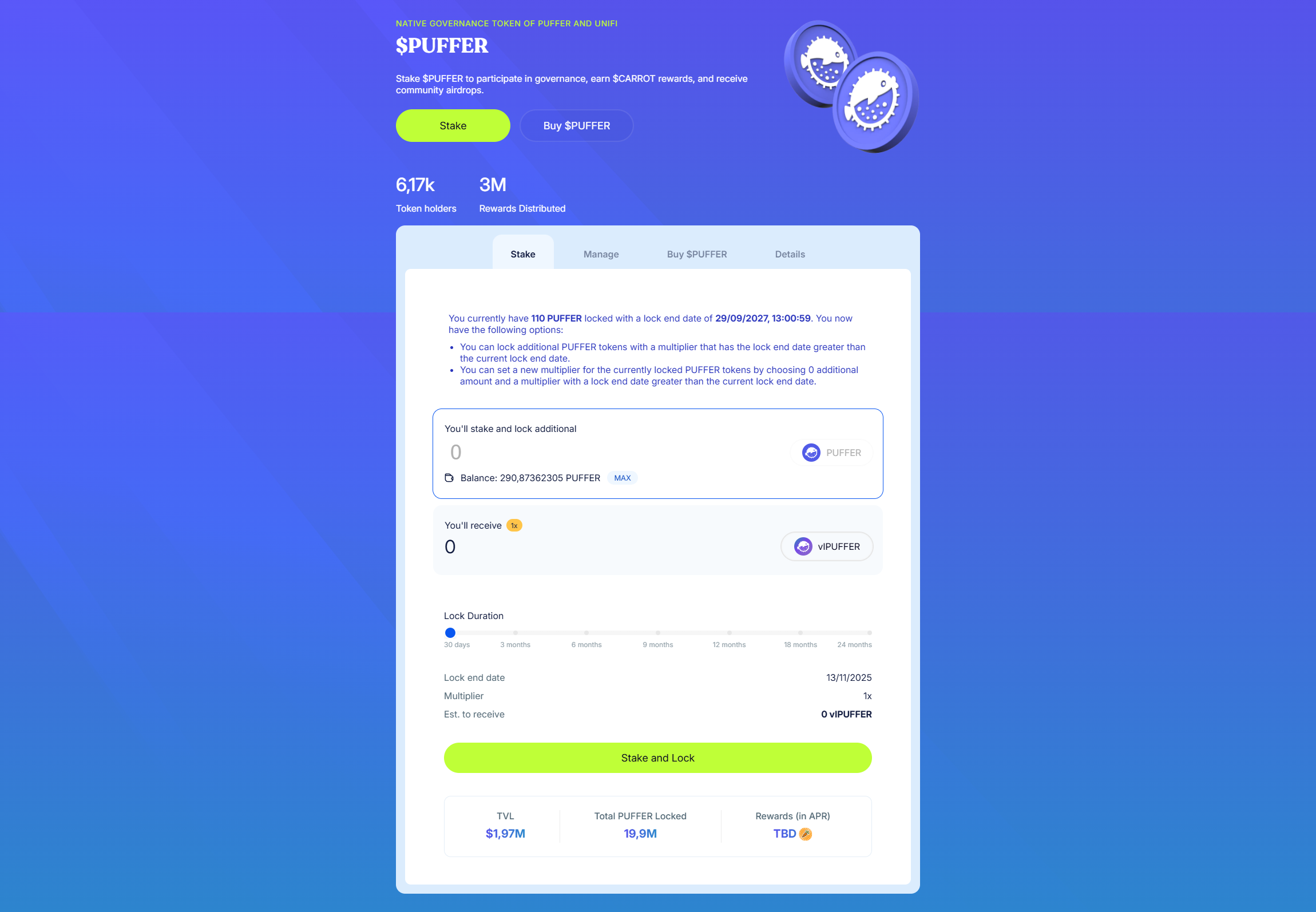

Once you have staked, you will see the information of your lock, where you can:

- Add more $PUFFER to increase your total locked amount and thus you vlPUFFER.

- Extend your lock duration to earn a higher multiplier, increasing your vlPUFFER as well.

- Do both to maximize your voting power.

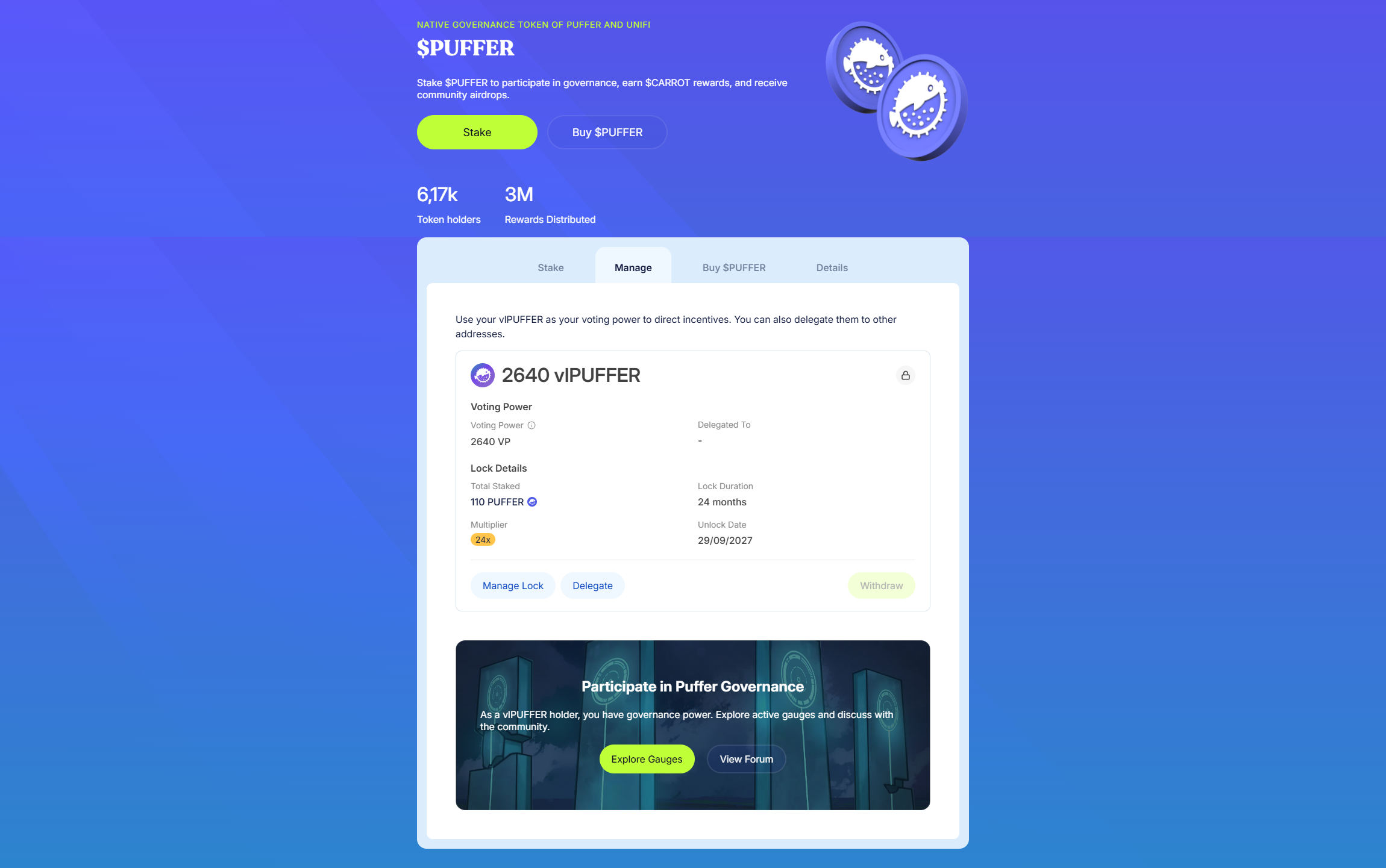

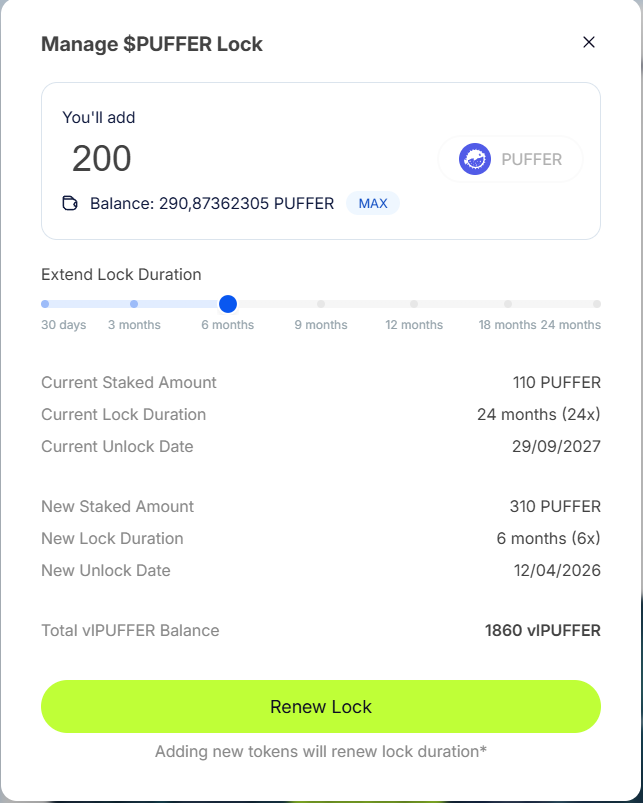

Managing Your Lock

In the "Manage" tab you can see the detail of your vlPUFFER

If you click the "Manage Lock" button, you will be able to renew the lock, by adding more $PUFFER, extending the lock duration or doing both, just as shown before:

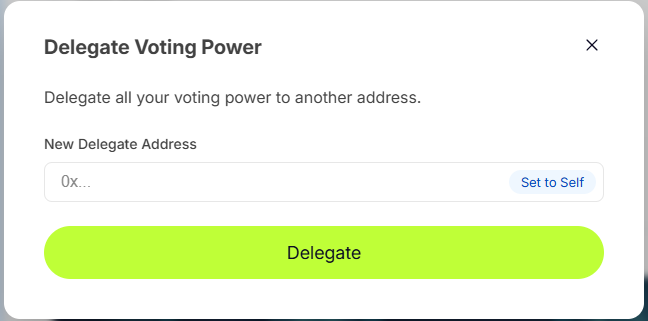

You could also click "Delegate" to delegate your voting power or click "Withdraw" to Unlock your tokens.

Vote Delegation

You can delegate your vlPUFFER voting power to another wallet. You can change or revoke the delegation without any time limitation.

Using different wallets, you can manage multiple locks. If you delegate all of them to your main account, you will keep your voting power centralized.

Example Strategy

- Lock 3 months, 12 months, and 24 months in different wallets.

- Delegate all voting power to your main wallet.

- Maintain flexibility in unlocking while concentrating governance influence.

Unlocking Your Tokens

When your lock expires:

- You can withdraw your $PUFFER tokens at any time after the end date.

- If you don't withdraw within 7 days, anyone can "kick" your expired lock:

- The kicker receives 1% of your locked $PUFFER as a fee.

- The remaining 99% is automatically returned to you.

Governance Power and Utility

Your vlPUFFER determines:

- The weight of your votes in governance proposals.

- Your influence over emissions and reward allocations.

- Eligibility for potential incentives (such as yield boosts or airdrops).

Security

vlPUFFER has been audited by BlockSec to ensure secure locking, delegation, and withdrawal mechanisms.

Key Rules

- Each wallet can have one active lock.

- You can only withdraw after expiry.

- You can delegate your voting power to a different account.

- vlPUFFER is non-transferable.

- Re-locking cannot reduce your current voting power.

- After expiry, withdraw within 7 days to avoid the kicker fee.