Overview

Puffer is a native liquid restaking protocol (nLRP) designed to harness the power of restaking.

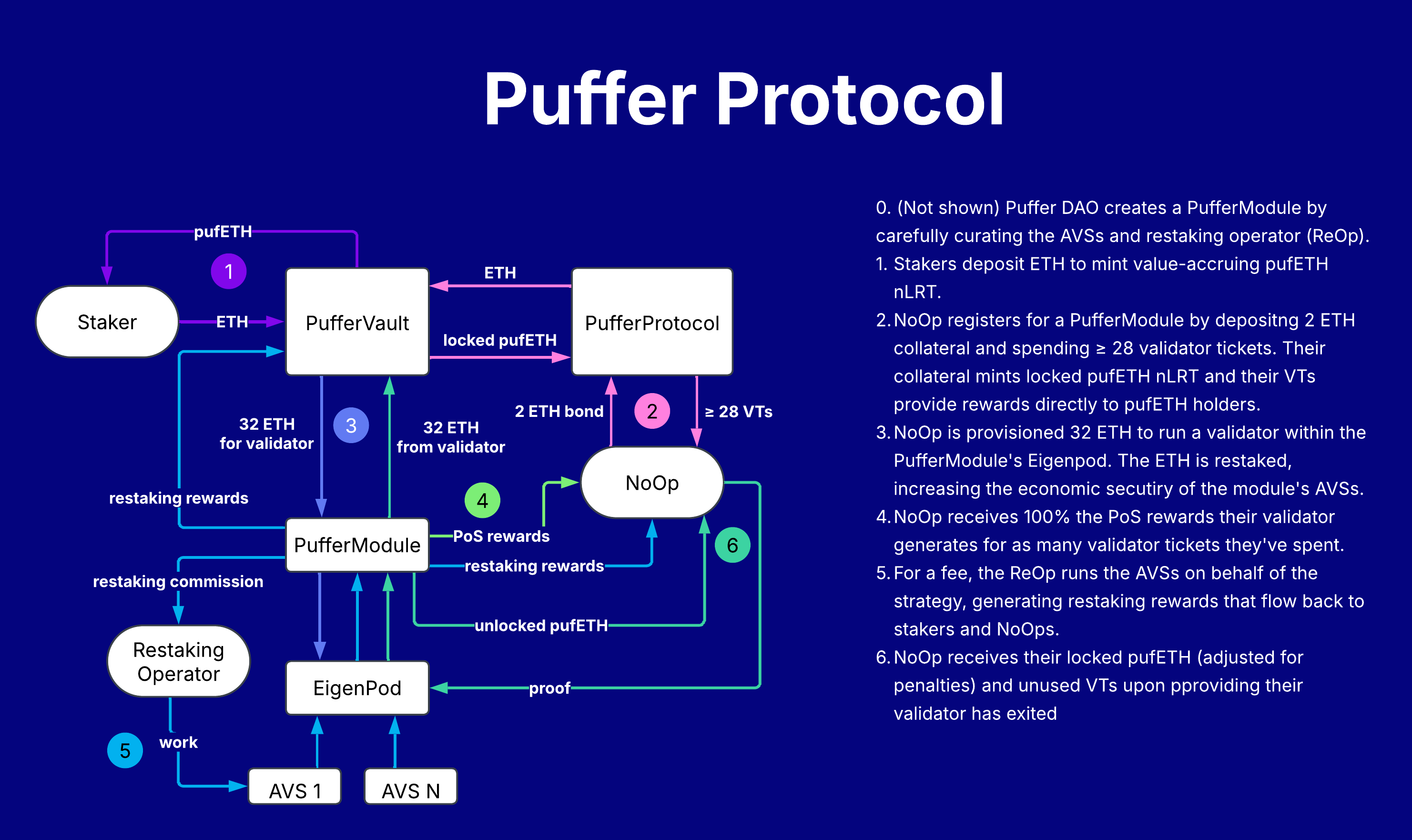

Puffer Walkthrough 👩🏫

0️⃣ Creating PufferModules

Puffer will begin with several empty PufferModules that will be populated as new validators join the protocol.

Puffer governance plays a crucial role in overseeing restaking, including adding new modules, managing their delegations to RestakingOperator contracts, and managing operators' AVS commitments.

For example, adding a new module to the PufferProtocol contract requires governance to:

- Vet and select the restaking operator to operate on behalf of a RestakingOperator contract.

- Vet and select the Eigenlayer AVSs that the RestakingOperator contract can opt in to.

- Delegate the module's ETH to the RestakingOperator contract.

1️⃣ Staking ETH

Stakers can deposit ETH and mint the pufETH nLRT via the PufferVault contract, which serves as a redeemable receipt for their restaked ETH. If sufficient exit liquidity is available, stakers can reclaim their ETH from the PufferVault. Over time, the redeemable amount is expected to increase from validator tickets and restaking rewards.

In contrast with conventional liquid staking tokens (LSTs), pufETH can provide strictly more rewards for its holders. Not only does pufETH encompass PoS rewards and restaking rewards, but its value can accelerate quickly due to validator ticket sales. Furthermore, the PoS rewards for stakers are decoupled from the protocol validators' performance.

2️⃣ Registering a NoOp Validator

To register a new validator, NoOps deposit validator tickets and 2 ETH as collateral to the PufferProtocol contract. In return, the protocol mints pufETH, which remains locked until it's confirmed that their validator has successfully exited. Locking pufETH serves to:

- Align NoOp incentives

- Safeguard staker ETH

- Increase NoOp profit margins

To ensure the safety of stakers, NoOps must distribute their encrypted validator keyshares to the Guardians' enclaves, allowing them to eject the NoOps if their validator balance falls too low or they run out of validator tickets. This requirement is to protect stakers and it will be upgraded to a trustless solution once Ethereum's protocol allows it via EIP-7002.

3️⃣ Provisioning ETH

Each RestakingModule contract will contain a queue of pending NoOp registrations. As the PufferVault accrues 32 ETH chunks from deposits and rewards, the Guardians will provision the chunks to the NoOps' pending validators, following a round-robin schedule to ensure all of the protocol's modules are serviced.

The provisioning step will create a new validator within the EigenPod whose ETH can be natively restaked on Eigenlayer to serve as collateral for its registered AVS. For this reason, the NoOp's validator's withdrawal credential is required to the module's EigenPod contract. After provisioning, the NoOp's validator will have deposited 32 ETH to the BeaconDepositContract and will await activation.

4️⃣ PoS Rewards

Once their validator activates, the NoOp is eligible to validate for as many days as the validator tickets they have deposited. Throughout this duration, the NoOp keeps 100% of the generated PoS rewards. Their execution rewards are immediately deposited to their wallets, while their consensus rewards accrue in the module's EigenPod and can be withdrawn following the NoOp withdrawal process.

Since NoOps receive 100% of the PoS rewards they generate, they are incentivized to maximize their validator performance, helping protect staker ETH.

5️⃣ Restaking Rewards

Restaking operators execute the AVSs on the module's behalf and receive a commission for their services. The accumulated fees from these AVSs enhance the value of pufETH. This mechanism allows stakers to achieve higher returns compared to conventional LSTs.

By participating in a restaking module, NoOps bear additional risks to their collateral. To compensate, they are granted a portion of the restaking rewards. This arrangement allows them to earn more rewards than through PoS alone, without the need for additional hardware or computational resources. They can access these rewards periodically, using the same NoOp withdrawal process as for consensus rewards.

️6️⃣ Exiting Validators

When a NoOp wishes to exit the protocol, they must first ensure their associated validator has exited the beacon chain. Once they present verifiable proof of their validator's exit, the contract tallies any penalties related to inactivity or slashing that the validator might have incurred. The corresponding pufETH amount, equivalent to the ETH penalties, is burned from the NoOp's locked collateral and the remainder is returned to the NoOp. This process ensures that stakers are appropriately compensated for any potential ETH losses that might have occurred during the validator lifecycle. Additionally, any unused validator tickets will be returned to the NoOp.